Value-Based Care: Beyond Today’s Obstacles to Greater Adoption

Let me start with my view: I hope health plans will significantly expand their value-based care arrangements in the coming year while simultaneously ensuring their models are viable and a win-win for their providers and effective in helping members and their care circles navigate appropriate care.

In short, today’s value-based care and alternative payment models–such as shared savings, pay for performance, pay for reporting, and condition-specific population-based payment–seek to reduce healthcare costs, increase healthcare coordination and quality, and alleviate physician burnout.

At the risk of dating myself, I have been helping health plans implement value-based care initiatives for more than 20 years. At its heart, value-based care and alternative payment models (APMs) offer financial incentives to efficiently deliver high-quality care. Knowing members trust their physician, health plans pay providers for the holistic, proactive and coordinated care of patients while measuring the quality of their performance.

There are a variety of APMs in the market. Global capitation–in which a provider receives a global fee for services delivered over a fixed period or an episode of care, with the goals of improving individual and population outcomes while reducing healthcare costs–is the farthest along the value-based care continuum. Other models include accountable care organizations (ACOs), PCP capitation, specialty and condition-based capitation, episodic bundling, quality incentive payments, and shared savings.

Value-Based Care Results

We are seeing signs that value-based care is working and healthcare leaders like me remain hopeful.

Humana, for example, showed that more Medicare Advantage patients in VBC models saw their providers in 2022 (85 percent versus 75 percent) and had better adherence with preventive screenings and medication. In total, Humana’s Medicare Advantage VBC program saved 23.2 percent in 2022, a medical cost savings of $8 billion compared to traditional Medicare.

That said, in the fourth quarter of 2023, Humana reported a $541 million overall loss and attributed “much of the blame on a higher-than-anticipated increase in Medicare Advantage costs.” At the time, the plan cited challenges with a “’complex and dynamic period of change’” as well as “unprecedented increases in medical cost trends.” Nevertheless, Humana leaders remain confident “in the growth outlook for Medicare Advantage and value-based care.”

Elevance Health offers another example. The company’s 2023 data shows the health plan’s value-based care programs are working. Two-thirds of its “medical spend was through value-based payment arrangements”, with 33 percent in shared-risk contracts, earning providers $1 billion in additional payments.

The plan also reported 2023 quality results:

- For the commercial population, value-based care led to better preventive care rates: a 2.9 percent increase in medication adherence for cholesterol, 6.5 percent for breast cancer screenings, 7.1 percent for colorectal cancer screenings, and 7.7 percent for well-child visits in the first 30 months of life.

- For the Medicare population, providers in value-based programs achieved higher clinical quality scores.

- For the Medicaid population, evidence-based care—such as well-child visits, diabetes eye exams, and high blood pressure control—was delivered more consistently by care providers in the provider quality incentive program.

Bryony Winn, president of Carelon Health, an Elevance Health company, wrote in a recent Fast Company article,

“VBC models also require payers to build infrastructure around payment, showing it incentivizes what we and care providers value most—better and more equitable health outcomes, increased patient and care provider satisfaction, increased access, and more affordable care. It’s why 63% of our total medical spend in 2023 was in VBC agreements, and why going forward, we’re all in.”

Mirroring other studies, a 2023 American Academy of Family Physicians (AAFP) survey showed that value-based care decreases burnout among family physicians. Even more telling, “higher capitation rates combined with greater overall percentage of revenue from capitation most effectively relieved physician burnout.”

Value-Based Care Adoption

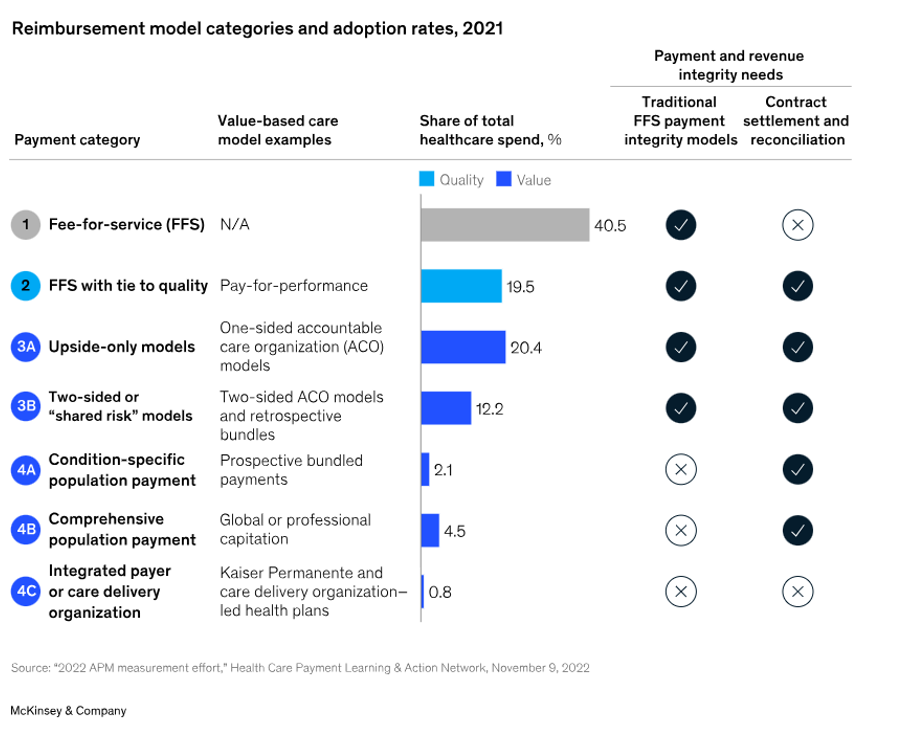

The Health Care Payment Learning & Action Network (HCPLAN) estimates that value-based care adoption nearly doubled from 2015 to 2021. As of 2021, nearly 60 percent of healthcare payments had at least some link to quality and value, ranging from pay-for-performance models to fully capitated reimbursement, but less than 20 percent incorporated two-sided risk, and capitated models are still under eight percent of spending.

Value-based care adoption: As of 2021, nearly 60 percent of healthcare payments had at least some link to quality and value.

Source: https://www.mckinsey.com/industries/healthcare/our-insights/payment-integrity-in-the-age-of-ai-and-value-based-care

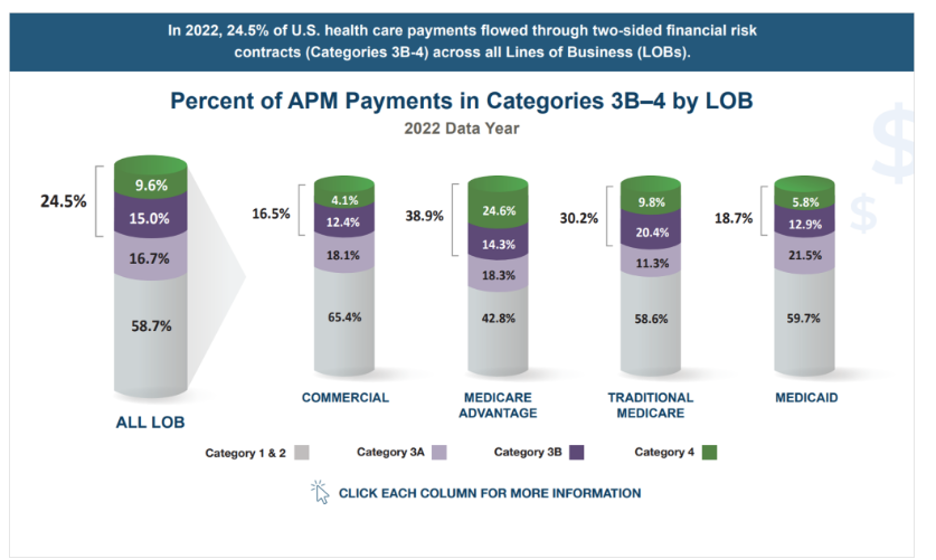

In 2022, more than half of healthcare payments “were made through value-based reimbursement models, with most of those payments tied to some degree of financial risk.” Nearly a quarter flowed through two-sided risk contracts (see 3B and 4 in the chart below).

This year’s data from CMS revealed approximately 13.7 million Medicare enrollees–almost half of beneficiaries in traditional Medicare–are in ACOs. This is a three percent increase from 2023 and progress towards the goal of bringing all 34 million traditional Medicare beneficiaries into value-based arrangements by 2030. Nearly 817,000 providers are participating, a 16.7 percent increase from 2023.

In 2022, more than half of healthcare payments were made through value-based reimbursement models.

Source: https://hcp-lan.org/apm-measurement-effort/2023-apm/

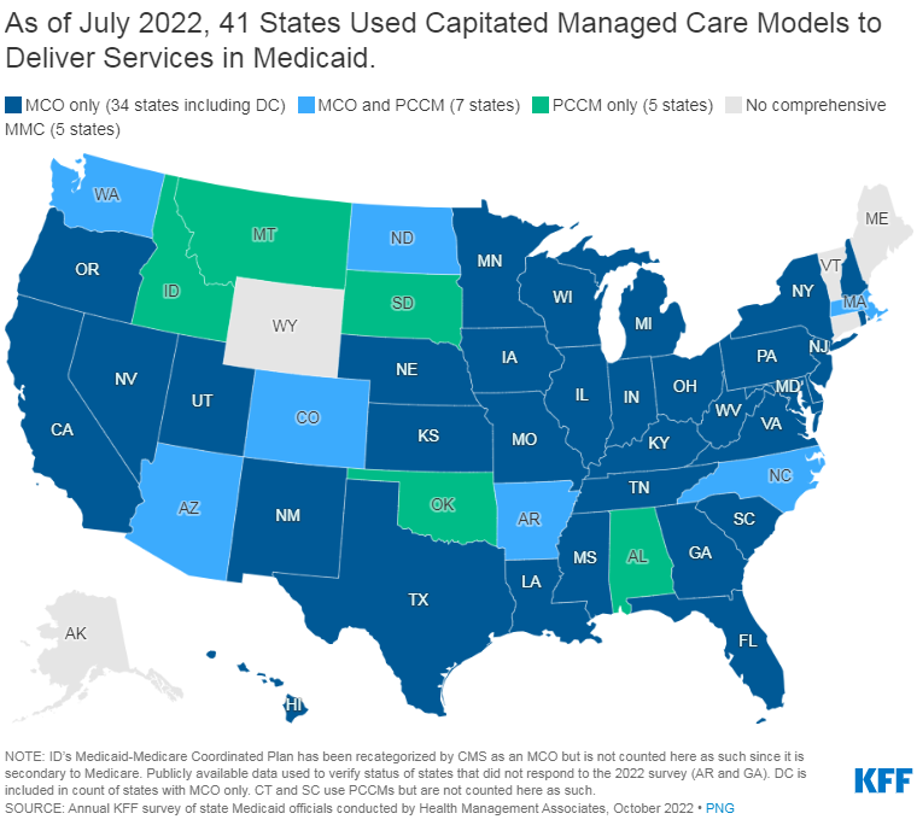

Likewise, Medicaid is embracing value-based care. The Kaiser Family Foundation found “capitated managed care is the dominant way in which states deliver services to Medicaid enrollees.” A majority of states (41) use capitated managed care and 72 percent of Medicaid beneficiaries are enrolled in comprehensive risk-based managed care organizations.

Nearly every state has some managed care in place–comprehensive risk-based managed care and/or primary care case management (PCCM) programs.

Source: https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-medicaid-managed-care/

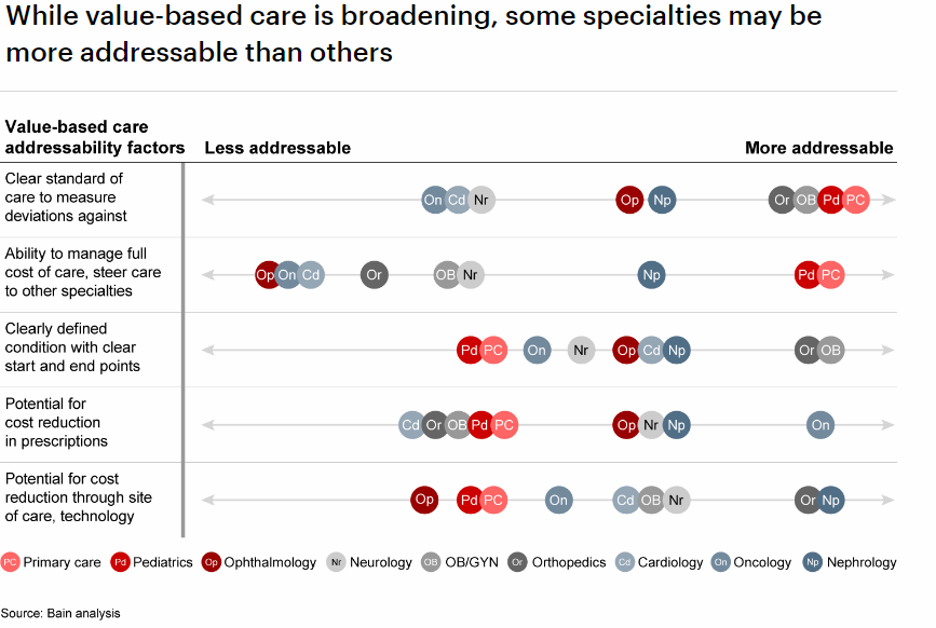

As Bain & Company found, value-based care initiatives are extending into specialty care. “Categories with more standardized and time-bound interventions (such as orthopedics, cardiology, OB/GYN maternal care, and others) have witnessed growth in episode-based payment models over the past few years.”

Value-based care initiatives are extending into specialty care.

Source: https://www.bain.com/insights/value-based-care-global-healthcare-private-equity-and-ma-report-2023/

Companies like Eleanor Health are bringing value-based care to behavioral health. As then-CEO Corbin Petro shared in mid-2022,

“The goal for Eleanor Health was always to move to population-based risk. Eleanor Health still has a number of bundled payment models with certain payers, but the company was able to start signing many population-based contracts towards the end of 2021 around two and a half years into delivering care.”

Value-Based Care: Obstacles to Greater Adoption

Some may conclude industry-wide profitability challenges could also limit greater adoption of value-based care models. But when the Deloitte Center for Health Solutions asked health plan CFOs about their priorities for improving profitability, the organization found they are “looking beyond cost reduction” and “exploring innovative tools and methods to enhance their financial performance.” Nearly one-quarter (23 percent) said increasing their risk-based business is a revenue growth opportunity.

Deloitte concluded,

“Value-based partnerships between health plans and providers can open greater revenue opportunities and lower costs for both. To date, however, these relationships have had mixed financial results. This is driven, in part, by inadequate capabilities and reluctance to accept downside risk. Emerging models that align growth and operating margin goals can enhance revenue stability, lower care costs, and accelerate growth for both parties.”

Another challenge is the fact that the administration of value-based care programs remains largely manual, reaching operational thresholds, driving extensive work and quality issues. Too often, programs are managed outside of the plan ecosystem, requiring high integration, but also leading to issues integrating with member benefits, patient liability, stop loss, and employer billing.

Today’s challenges in VBC administration hinder broader adoption. That’s why NASCO is prioritizing the combination of utilization processing with analytics to administer benefits, providing transparency for servicing and empowering engagement with providers and members across medical network providers as well as third-party vendors.

At NASCO, we are committed to helping Blue Cross and Blue Shield plans innovate in value-based care while competing nationally and managing locally. Stay tuned for a future blog about how NASCO’s data-centric settlement offering is helping health plans successfully administer value-based care arrangements and alternative payment models.

To learn more about NASCO and value-based care, read Lori’s previous blog, Value-Based Care: What’s Not Working